43+ avoid capital gains by paying off mortgage

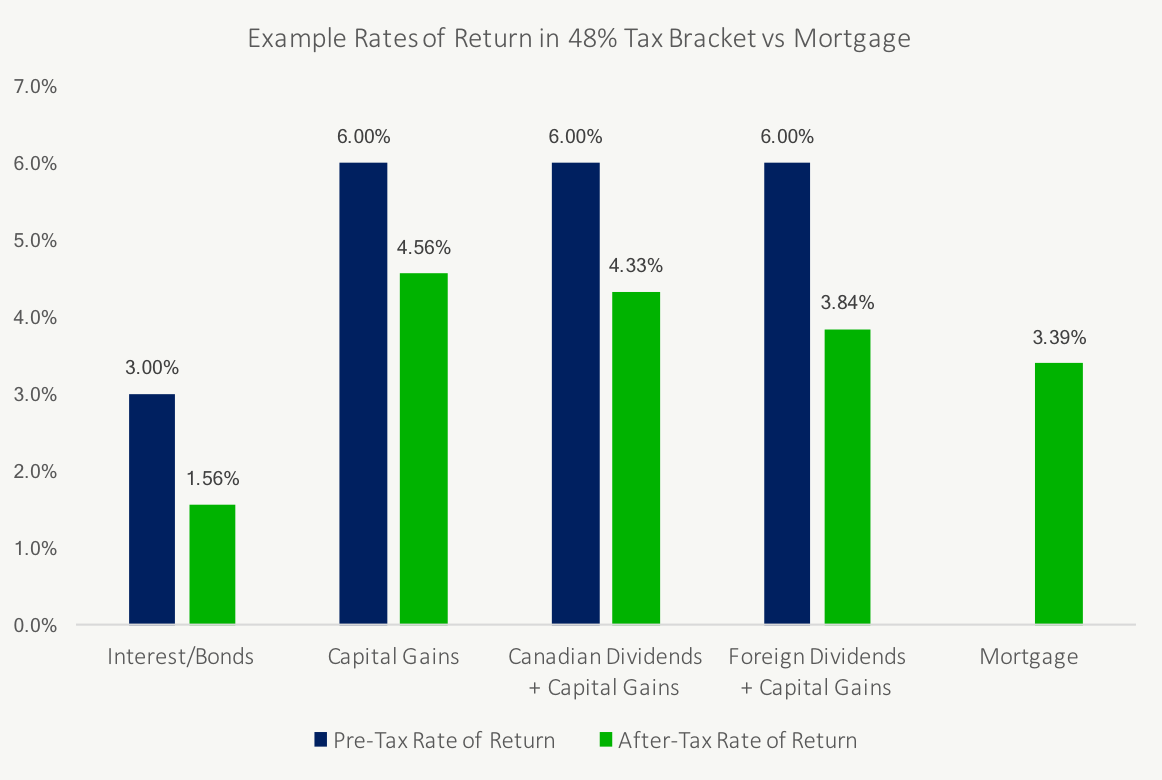

Web Basic rate taxpayers pay 875 percent on any dividend income they receive above the annual allowance while higher rate taxpayers pay 3375 percent and. Short-term capital gains are taxed as ordinary income at rates up to.

33 Pros And Cons Of Living In Berlin As An Expat

Web There are ways to avoid paying the hefty capital gains tax when selling your home though.

. Long-term capital gains that is gains on assets. Web Capital gain sales price - purchase price and the mortgage is just one of the many ways one can finance that purchase. Web In this case when you sell the house your capital gain will 80000 which is 100000 minus the 20000 spent on home improvements and fees.

If the property is your primary. If you have any capital LOSSES carried forward from a. In many cases property investors can purchase rental or.

Web Avoiding capital gains tax on an investment property begins before you start considering the sale of the property. Web You would owe capital gains taxes on 190000 the difference between your purchase price and your sale price. The primary means of avoiding capital gains tax is to have owned the house and lived in it as your primary.

Web If you find that realizing a capital gain will be too costly without means to significantly offset or reduce it another option to consider is just not taking the gain at all. The amount of the mortgage has no bearing. Web How to avoid capital gains tax on home sales.

Web The IRS allows you to avoid paying capital gains taxes on the first 250000 of profit from the sale of your primary residence if youre filing single and up to. There are a few higher rates for particular items but they dont apply to a home sale. Web Before 1997 the only way most people could avoid tax on capital gains realized from selling their primary residence was to purchase another house within two years for more.

Web If you have owned and occupied your property for at least 2 of the last 5 years you can avoid paying capital gains taxes on the first 250000 for single-filers and. Web You can avoid a significant portion of capital gains taxes through the home sale exclusion a large tax break that the IRS offers to people who sell their homes. Web Do you still get charged capital gains tax if you have paid off the mortgage on a house whilst renting then decide to move into it.

Web Short-term capital gains are also taxed at your regular tax bracket or your ordinary tax rate. Banking Investing Insurance Credit Cards Taxes Personal Finance. Web If you sell rental or investment property you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of.

Web The long-term capital gains tax rate varies between 0 15 and 20. Web If you choose to sell your property to free up money to pay off a second mortgage you might be able to get that money tax-free.

Pdf Attitudes Towards Funding Of Long Term Care Of The Elderly

Fundamentals Of Business Finance Autumn 2019 25300 Fundamentals Of Business Finance Uts Thinkswap

Dave Ramsey S Early Mortgage Pay Off Advice Good Idea

Mortgage Tax Relief Guide From Taxcafe

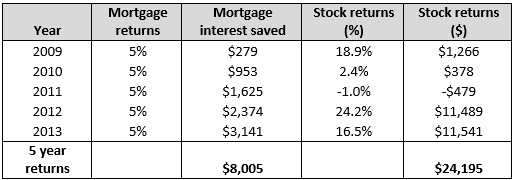

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Financial Mistakes To Avoid Know 8 Worst Financial Mistakes To Avoid

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Robin Brown En Linkedin Pmmc2023

Ask An Ex Banker Mortgages Part Ii Should I Pay My Mortgage Early Bankers Anonymous

Free 43 Receipt Forms In Pdf Excel Ms Word

Pdf Rethinking Property Tax Incentives For Business Rethinking Property Tax Incentives For Business

Can I Avoid Capital Gains By Paying Off Mortgage

43 Business Ideas To Get You Started In Visakhapatnam Earn Upto 50 Thousands

Are There Disadvantages To Paying Off Your Mortgage Early Level Financial Advisors

Pdf Income Tax And Vat Issues Concerning Leases After Ifrs 16 Convergence In Indonesia

Should You Pay Your Mortgage Off Early Calculator Included Young Dumb And Not Broke

Should You Consider Paying Off The Mortgage Early Or Investing Instead Planeasy